Green Industry Strong Through 2025

When looking for solid short and long-term predictions, we follow economists that have a proven track record. Our favorites are Dodge Analytics and ITR Economics because both are level-headed and show that proven history. Recently they published several articles and webinars that provide valuable forecasting for our Green Industry as a whole and your business in particular. Let’s discuss short and long-term implications you can use to prepare your business for supply shortage, interest rates, inflation, the housing bubble, and commercial construction.

Dodge Data & Analytics (PRNewsFoto/Dodge Data & Analytics)

Both ITR and Dodge predict profitable market conditions for the Green Industry through 2025. This is an opportune time to grow the size of your business and/or your profitability. If you are looking to sell your business, you can take this time to improve your EBITDA* and specifically your cash generation to gain a higher sale price in 2024-25. (*EBITDA means earnings before interest, taxes, depreciation, and amortization – Investopedia)

In this article, we will focus on forecasting details from the Green Industry perspective. However, before we dive in, first a disclaimer: major future actions or incidences may affect the timing or occurrence of these predictions, but Dodge and ITR work hard to consider all possible scenarios.

Why Supply Price Increases?

According to the talking heads on cable news, we are in a period of rising “inflation.” However, what you see is a temporary price elevation and not systemic inflation. Let’s explore the difference using the predictions from Dodge and ITR.

The COVID recession panic caused many raw material producers and manufacturers to cut back production. The government responded by pumping trillions of dollars into the economy. At first, businesses and people hoarded this money, evidenced by the cash-rich business balance sheets and the 4x normal personal savings rate. While most sectors saw this benefit, several did not, and those businesses and the people working in them were badly hurt. The government distributions helped temper their pain.

With a lot of hoarded cash, people decided to invest heavily in their homes and other personal wants, and as a result, the demand for many products exploded. But, unfortunately, stockpiles of raw and manufactured goods were slim, and production and supply of many materials could not keep up with the sudden surge of demand.

In times of heavy demand with low supplies, prices go up. However, supply issues will alleviate in a few months, and prices for many goods will also subside. While producers will try to keep prices at elevated levels, competition will force pricing to a market sustainable level.

With that said, there is a systemic inflationary period brewing. However, it will not happen this year, and 2022 will be a deflationary year. As we move through 2023 into 2024, real inflation will begin. The trillions of dollars our government dumped into our economy is a major causal factor for that inflation.

Supply Shortage Takeaways

- You will pay higher prices this year for many materials, but these price hikes will ease off in 2022. Overall, construction materials have gone up 24%; however, the green industry supplies have been hit even harder. Products based on oil have taken the hardest hit, including many products made with chemicals, plastics, and copper.

- You can expect spot shortages of certain items. However, if you prepare for those shortages, there’s no need for panic. Best practices include good material management, which includes only stocking up on products you can install and bill for in the next 30 days.

Make Hay While It Lasts

According to Dodge and ITR, all indications predict a downturn in 2026, which is driven largely by the inflationary cycle created by government spending. After that, inflation will be active, but hyper-inflation is not expected, and stabilization is predicted for early 2027.

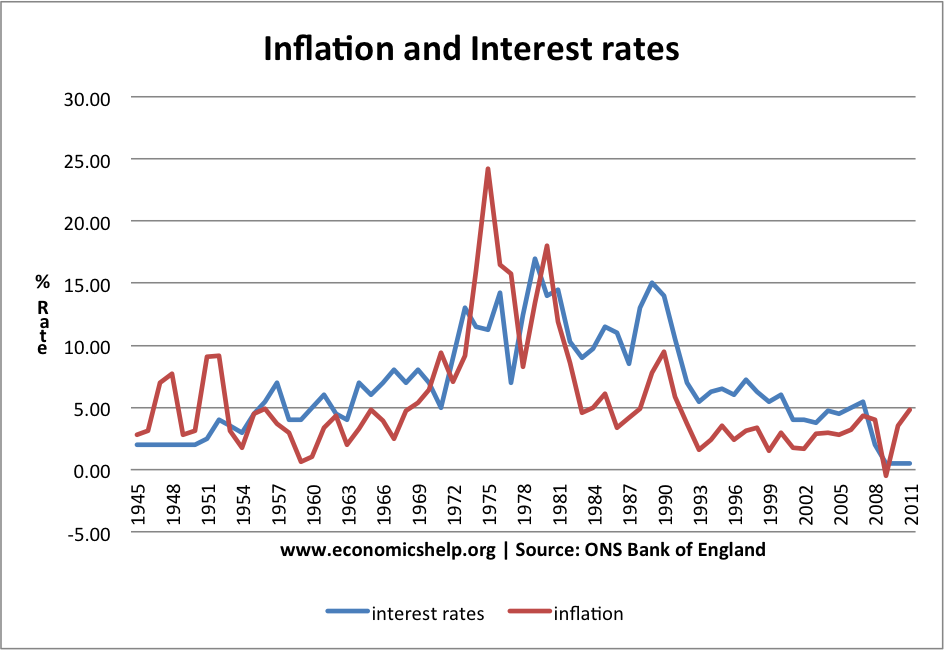

Make hay now. We have about three years of good market growth before this recession starts. If you desire to grow your business and need to borrow money, we recommend doing that soon. There will be higher interest rates during a downturn, which makes it more expensive to borrow money to expand operations. Interest rates tend to lag inflation; once inflation rates are rising, interest rates will soon follow.

No recession is trivial, but those correcting a marketplace tend to be mild and easily navigated if you are ready. First, make sure you have the cash to make your debt payments and keep your good staff. A strong cash position makes such recessions not only survivable but will allow you to grow your business and hire your competitor’s laid-off best people. Another good tactic is to sell off any assets you do not utilize before the recession, such as equipment or material stock.

Be ready to scale back expenses, where labor is your biggest and most fluid expense. However, avoid off-loading people until you must because labor shortages are still a big problem. In addition, having the labor to take advantage of the recovery (starting in early 2027) should be a concern.

Expect a downward pressure on stock market levels. Coupled with higher interest rates, this period will be difficult for people, especially business owners, to build personal wealth. Your financial advisor can help you at least maintain your investment wealth. If you have money to invest, you’ll find many stocks at a bargain price.

Recession and Selling Takeaways

- Consult your financial advisors about preparations for the coming recession. As always, cash is king in a downturn.

- Choose not to participate in the recession! Of course, you can’t ignore it, but you can make strategic plans to get through it and even profit from it. When downturns happen, others will make panicky dumb mistakes, and you can be prepared to take advantage of their errors.

- Keep your people because our current labor shortage is not going away. We have demographic issues that will take years to change. So do what you must to have the cash to keep your people employed.

- If you want to sell your business, the best time to execute that will be between 2023 to early 2025. You should use the next two to three years to beef up your cash generation, EBITDA and clean up your financial statements. If you don’t sell between 2023-2025, you will need to wait for the recovery period in 2027 when progressive operators are making investments. It may take you a few years to rebuild your financial strength after the recession is over.

What About the Housing Bubble?

The housing construction and renovation exploded in 2020 and continues to date. Growth like that automatically creates an expectation of decline; already, a fear of a new housing bubble a la 2008 has taken hold. The question being asked most often is: when will the Housing Bubble burst? Although we are in a bubble-like period, the bursting point is at least a few years down the road. In our opinion, housing construction may not experience a bursting event, but instead more of a fizzle as inflation and rising interest rates chase people out of the market.

ITR economist Jackie Green wrote on June 22 why the improved housing market will last a while. She gives four reasons to support her opinion.

- Inventory is Low: there aren’t enough homes available to satisfy Gen X and Millennial buyers. New home construction is booming and will continue to be strong for the next couple of years.

- Liquidity is High because that massive amount of personal savings indicates that people have the money to build or buy a home. Combine that with the fact that a massive number of Millennial buyers want to and can enter the market; therefore, housing will continue strong.

- Default Rates are Low: Consumer cash strength has cut loan default rates by 90%, indicating that home buyers are in good financial health.

- Bank Lending Demand is Strong: Interest rates are still at a historic low, and consumers are in good financial shape, so it is easy to get loans. Only when there will be a large increase in mortgage rates will loan demand slack off.

Another trend that plays a role is that people are moving from large urban centers to surrounding suburban areas and even to smaller towns and states. Those studying these phenomena say this trend, amplified by COVID, will impact the industry for many years. These factors point to a good housing market for the coming two to three years, and let’s not forget about the robust home renovation demand! This is a favorable market situation for landscapers and good news for the Green Industry!

Key Housing Takeaways

- If you serve the housing sector, expect good demand for the near-term future. So push forward to gain as much business as you can handle.

- Your biggest hurdle is and will be finding employees to do the work. We offer you no magic bullets other than improving your company culture to nourish and reward your staff. If you make working with your company fun, you will both retain your existing workers and attract good new team members.

Will Commercial Building Ever Come Back?

Yes, commercial building is back and will continue, but how big and how fast depends on many aspects such as the region of the country, local economies, and local demographics. There is a continuing increase in commercial building construction, although some types of construction fare better than others. For example, new office construction is pathetic, but renovations of existing office space are surging. The big commercial building winner is warehousing. However, most warehousing facilities have limited landscaping needs, so they are not a great target market for Green Industry contractors.

Projects attached to public funding are typically slow in making their way through the design phase. However, don’t get too excited because there are not many of these projects. Nevertheless, medical facilities are a bright spot, and many retail sectors benefit from the elevated consumer spending, which supports an increase in renovations of retail space.

Key Commercial Building Takeaway

- If your business focuses on commercial construction, we recommend focusing on medical facilities, office, and retail space renovations.